operating cash flow ratio negative

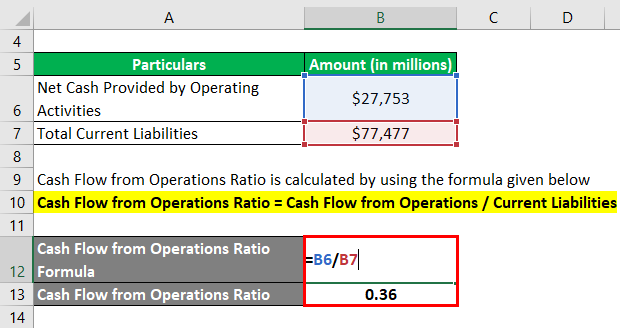

The formula to calculate the ratio is as follows. Operating cash flow is a measure of the amount of cash generated by a companys normal business operations.

Negative Cash Flow Investments In Companies

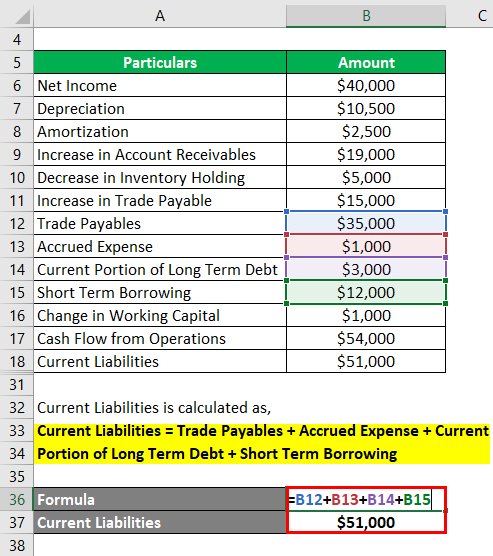

Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and income Deferred income taxes Increase in inventory Increase in accounts receivable Increase in accounts payable Increase in accrued expense Increase in unearned revenue.

. In the second scenario above because the operating profit is negative the profit margin percentage will be negative. The company is probably struggling if they have a negative operating cash flow. Negative cash flow is when your business has more outgoing than incoming money.

But also remember negative cash flow or lower ratio always does not indicate poor performance it has happened due to company. A negative cash flow can be used in the field of personal finance as well as corporate. What does a negative cash flow margin mean.

We can see that net cash used in investing activities was -1859 billion for the period highlighted in green. Ad 93 of small business owners are constantly leaking money on useless and unnoticed things. Interpretation of Operating Cash Flow Ratio.

If a company has an operating cash flow margin of below 50 this suggests that the company is not efficiently making sales into cash and instead may have high expenses. The detailed operating cash flow formula is. A good operating cash flow margin is typically above 50.

A ratio less than ONE indicates short-term cash flow problems. Negative operating cash flow is a situation in which a company or business does not have access to the necessary funds when they are needed to meet expenses. This signals short-term problems and a need for more Cash.

Otherwise it will trap in debt in near future. A negative cash flow margin is an indicator that the company is losing. Indicating the cash flow is more than sufficient to meet the short-term financial obligations.

Dividing -50000 by 500000 to get -01 or -10. You cannot cover your expenses from sales alone. Operating Cash Flow - OCF.

The operating cash flow can be found on the. When the ratio is low or negative it could be an indication that the company needs to adjust its operations and start figuring out which activities are sinking its income or whether it needs to expand its market share or. For example if you had 5000 in revenue and 10000 in expenses in April you had negative cash flow.

When the outflow of cash is higher than the inflow of cash the firm enters a negative financial state. An operating cash flow ratio of less than one indicates the oppositethe firm has not generated enough cash to cover its current liabilities. The two primary drivers for.

Instead you need money from investments and financing to make up the difference. A ratio greater than ONE indicates good financial health. On the other side if the operating cash flow ratio is lower than one means company cash flow is negative and the company needs to improve performance or increase its capital.

Cash Flow from Operations refers to the cash flow that the business generates through its operating activities. An operating cash flow ratio of less than one indicates the oppositethe firm has not generated enough cash to cover its current liabilities. A ratio smaller than 10 means that your business spends more than it makes from operations.

To investors and analysts a low ratio could mean. Operating cash flow indicates whether a company is able to. Use the formula below to calculate your companys operating cash flow ratio.

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. Operating Cash Flow Margin. Negative OWC indicates that operating current assets are lower than operating current liabilities and this provides the business with access to free short-term funding.

This number can be found on a companys cash flow statement. Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you make. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales.

Get 3 cash flow strategies to stop leaking overpaying and wasting your money. Operating cash flow Net cash from operations Current liabilities.

Operating Cash Flow Ratio Calculator

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Ratio Definition And Meaning Capital Com

Cash Flow From Operating Activities Direct And Indirect Method Efm

Negative Cash Flow Investments In Companies

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

Negative Cash Flow Investments In Companies

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

What Is Operating Cash Flow Ocf Definition Meaning Example

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Operating Cash Flow Formula Calculation With Examples

Operating Cash Flow Efinancemanagement Com

Negative Working Capital Causes And Free Cash Flow Impact Excel Template

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Ratio Formula Guide For Financial Analysts

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)